NIRS Study Finds Americans Support Pensions to Address Retirement Crisis

A whopping 83% of working age Americans surveyed agree that having a pension makes it more likely to have a secure retirement, the National Institute on Retirement Security found in a recent study. Without a pension, most middle-class Americans won’t accumulate enough savings to be self-sufficient in retirement, NIRS said. The survey found that 77% […]

Bloomberg Law: Athene-Linked Pension Cases Strike at Need for New DOL Guidance

Annuity-only providers such as Athene may be uniquely prone to risks, because they lack the asset diversification individual life insurers enjoy, said Norman Stein, senior policy counsel at the Pension Rights Center, which advocates for the return of more traditional defined-benefit pensions and opposes pension risk transfers.

Bloomberg Law: AT&T, Lockheed Suits Mark First Real Test for Pension Transfers

Labor Department guidance requires employers seek out the “safest available annuity,” Norman Stein, senior policy counsel for the Pension Rights Center, said. That standard may not be satisfied if employers opt to work with an insurance company facing significant criticism instead of one that’s universally respected, he said.

ASPPA: Recordkeeping in the Electronic Age

Recordkeeping today is not your grandfather’s recordkeeping. Maybe not even your older sibling’s. So guidance and education from the Department of Labor (DOL) would be helpful in adjusting to the changes that have taken place, concludes a recently released report.

InvestmentNews: Companies transferred billions in pension assets to annuities. Here come the lawsuits

If the lawsuits progress, there’s a lot that observers might learn about how companies solicit and evaluate bids, said Norman Stein, senior policy counsel and acting legal director at the Pension Rights Center.

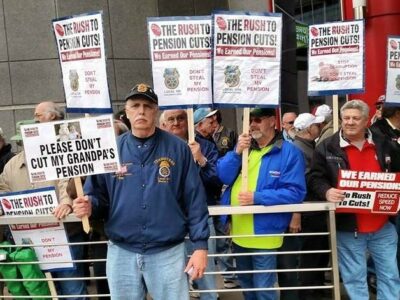

PRC Supports Senate Committee in Quest to End Retirement Income Crisis

By David Brandolph The Pension Rights Center weighed in last week with the Senate Health, Education, Labor and Pension Committee, stating that both short-term incremental and long-term bold solutions must be considered and implemented if we are to help millions of Americans avoid the hardship of a financially calamitous retirement. Committee Chair Bernie Sanders (I-VT) […]

Forbes: One Easy Way To Boost Your 401(k) Account, Starting Now

“Participants who withdraw plan funds to cover non-retirement expenses,” notes the Pension Rights Center, “no matter how justified, are shortchanging their future. Every dollar withdrawn will no longer be in the account where it can grow tax deferred. That lost principle, combined with the loss of potential interest and investment gains over what could be […]

Pension Rights Center Statement for Senate HELP Committee

The Pension Rights Center’s Executive Director, Karen Friedman, submitted the statement for the committee’s February 28 hearing titled “Taking a Serious Look at the Retirement Crisis in America: What Can We Do to Expand Defined Benefit Plans for Workers.”

Pension Rights Center Informs Senate Committee on Solutions to Retirement Crisis

The Pension Rights Center submitted a statement today from its Executive Director Karen Friedman telling the Senate, Health, Education, Labor and Pension Committee that “too many Americans are and will be facing an inadequately funded retirement with all the hardships that entails.” PRC, a nonpartisan, consumer organization that works to protect and promote the retirement […]

Pensions & Investments: Congress should reject attempts to block fiduciary rule using spending bills – coalition

The Save our Retirement Coalition — made up of nine organizations, including AARP, AFL-CIO, Better Markets and Pension Rights Center — specifically asked that Congress reject any appropriations riders aimed at prohibiting the use of funds for finalizing, implementing or enforcing the Labor Department’s proposed rule in a letter dated Feb. 15, sent to Senate […]

More Resources Now Available for Finding Lost Retirement Plan Benefits

By Jane Smith There is a new resource for the many people who are entitled to retirement plan benefits but can’t locate their former employer to claim those benefits. Those searching for benefits can start by checking out the “Find Unclaimed Retirement Benefits” search tool on the Pension Benefit Guaranty Corporation’s (PBGC) website. This tool […]