Expanding Retirement Coverage Highlights:

The Latest on Expanding Retirement Coverage:

NIRS Study Finds Americans Support Pensions to Address Retirement Crisis

A whopping 83% of working age Americans surveyed agree that having a pension makes it more likely to have a secure retirement, the National Institute on Retirement Security found in a recent study. Without a pension, most middle-class Americans won’t accumulate enough savings to be self-sufficient in retirement, NIRS said. The survey found that 77% […]

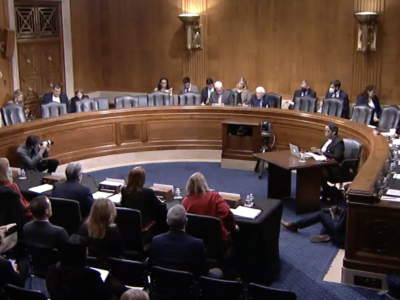

PRC Supports Senate Committee in Quest to End Retirement Income Crisis

By David Brandolph The Pension Rights Center weighed in last week with the Senate Health, Education, Labor and Pension Committee, stating that both short-term incremental and long-term bold solutions must be considered and implemented if we are to help millions of Americans avoid the hardship of a financially calamitous retirement. Committee Chair Bernie Sanders (I-VT) […]

Our 2024 Resolutions Reflect our Commitment to Retirement Security for All

By Karen Friedman The New Year is always a great time to take stock and resolve to do better. I’m already making headway on my personal goals of hitting the gym, eating healthier (mostly), and generally getting in better shape. Our resolutions at the Pension Rights Center, however, are a bit more ambitious. We’re working […]

Return of Traditional Pension, Use of Hybrid Structures Touted in Media

By David Brandolph Lately, private-sector traditional defined benefit plan pension plans have been getting some well-deserved attention in the media. Articles in the New York Times and Wall Street Journal have been reenforcing what we already knew–that American workers value the guaranteed lifetime income offered by traditional defined benefit plan pensions. But these articles also […]

Bloomberg Law: UAW Aims to Restore Retiree Benefits Given Up in 2008 Crisis

At the center of a historic UAW strike against all three major US automakers is an effort against long odds to reclaim retirement benefits workers conceded decades ago as manufacturers teetered on the brink of collapse. United Auto Worker union activists say they want back the guaranteed lifetime pension payments and retiree medical care they […]