Looking for help with your retirement plan?

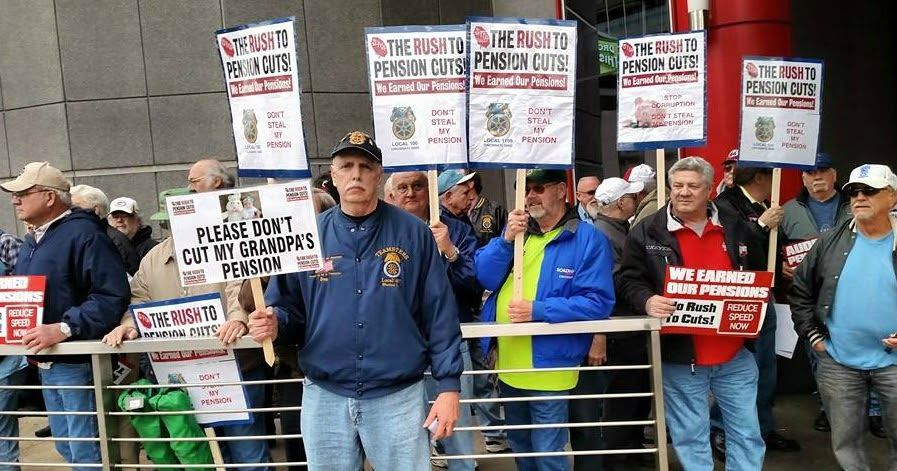

The Pension Rights Center’s Pension Promises Initiative (PPI) is a multi-year, multi-faceted education and grassroots effort created to help solve the multiemployer pension crisis – a goal largely attained in 2021. PPI is supported by the RRF Foundation for Aging as well as organizational and individual contributors.

The Pension Rights Center has launched an Initiative on Retirement Benefits at Divorce to identify why so many women are struggling to obtain the benefits they were granted at divorce and to find solutions to these problems. The Pension Rights Center is partnering on this initiative with employers and retirement plans, family law judges and attorneys, and groups that advocate for the rights of women, survivors of domestic violence and the LGBT community.