Tax Expenditures for Retirement Plans

The tax law recently enacted by Congress includes a great many provisions. Some are easy to understand. Others are not. Among the least understood provisions are those that modify “federal tax expenditures.” This fact sheet explains what tax expenditures are and how they affect retirement plans.

What are Tax Expenditures?

Tax expenditures are commonly called “tax breaks.” They are tax provisions, such as deductions, exclusions, or credits that reduce the amount of federal taxes owed by certain individuals and businesses. Congress creates tax expenditures to encourage behaviors and activities that promote specific public policies. Some tax expenditures reduce the amount of taxable income, such as deductions and exclusions from income. Tax credits directly reduce the amount of tax owed. Special tax rates can reduce taxes owed for certain types of income, such as capital gains. Tax expenditures also include tax deferrals, such as the delay in taxing contributions and earnings of some retirement accounts until retirement.* Tax expenditures are also called “tax subsidies” and “tax preferences.”

Examples of tax expenditures include the –

- deduction from income for interest paid on home mortgages to encourage home ownership;

- exclusion from income of health insurance premiums paid by employers to encourage companies to provide health insurance for their employees;

- exclusion from income of earnings in college savings plans to encourage parents to save for their children’s higher education;

- credit subtracted from taxes owed for contributions to retirement savings plans from individuals in specific lower-income brackets to encourage saving for retirement.

Tax expenditures reduce government revenue and are indirect ways that all taxpayers support specific programs or activities. Unlike direct spending by the government, tax expenditures are not shown as costs in the federal budget that Congress passes each year. However, each year both the Congress and the Treasury Department estimate the amount of lost revenue attributable to tax expenditures. Before the tax bill of December 2017 was enacted, the Congressional Budget Office estimated the cost of tax expenditures for fiscal year 2017 will be $1.5 trillion.**

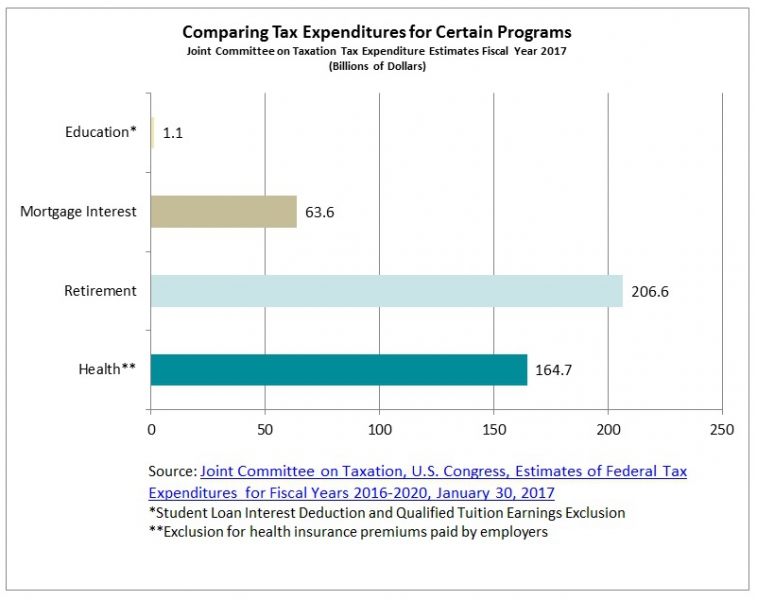

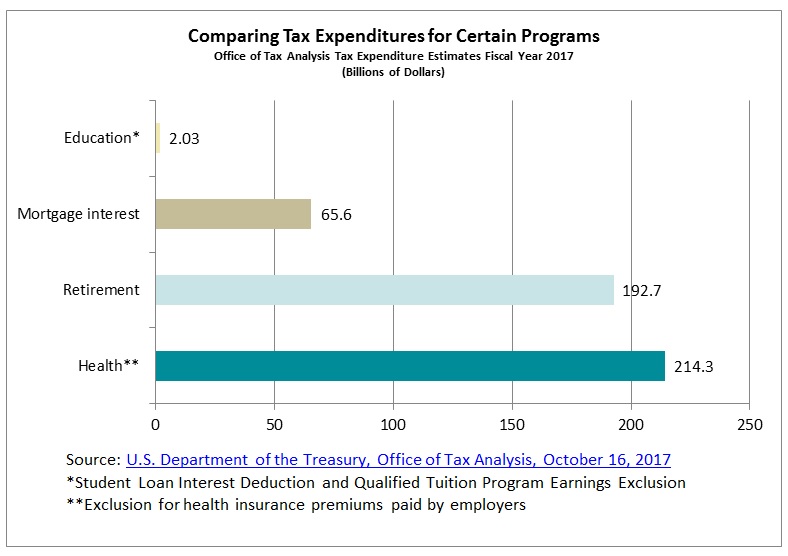

Since tax expenditures represent tax revenue that is not collected or is delayed the amount of each tax expenditure must be estimated. Tax expenditure estimates are calculated by the Joint Committee on Taxation of the U.S. Congress and the Office of Tax Analysis of the U.S. Department of the Treasury.

* Tax expenditures are defined under the Congressional and Impoundment Control Act of 1974 as “revenue losses attributable to provisions of the Federal tax laws which allow a special exclusion, exemption, or deduction from gross income or which provide a special credit, a preferential rate of tax or a deferral of tax liability.”

** “The Budget and Economic Outlook: 2017 to 2027” Congressional Budget Office, January 2017, Figure 1-4 Page 100. A general discussion tax expenditures begins on page 23.

Joint Tax Committee tax expenditure estimates for 2017

Office of Tax Analysis tax expenditure estimates for 2017

What are Tax Expenditures for Retirement Plans?

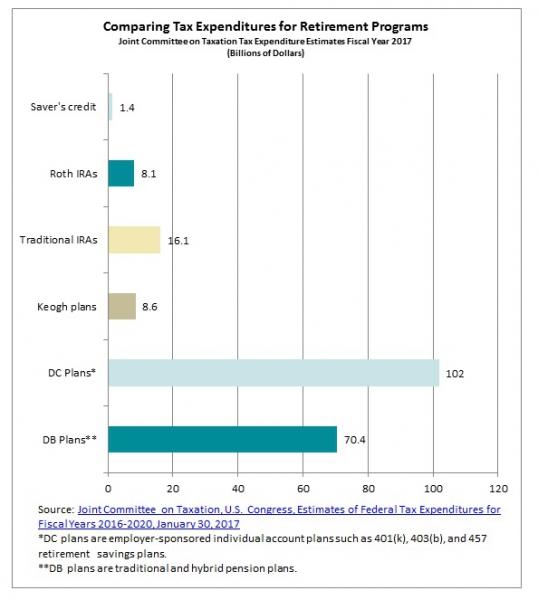

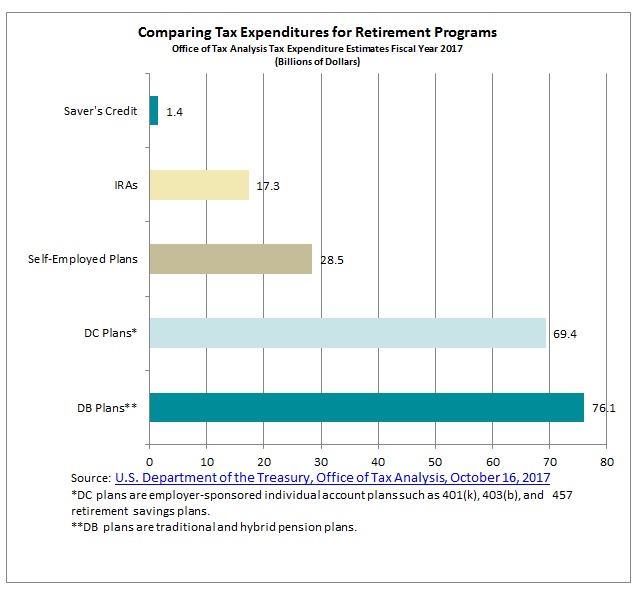

The tax expenditures for the most common retirement plans are “deferred” tax expenditures. Income taxes on contributions to retirement plans and retirement savings accounts, and investment earnings on the contributions, are deferred until an individual either begins receiving retirement income or takes a lump-sum payment or payments from a retirement plan or retirement savings account.

The most common retirement plans benefiting from “deferred” tax expenditures are:

*401(k), 403(b), and other retirement savings plans.

*traditional pension and profit-sharing plans

*Individual Retirement Accounts (IRAs)

Roth IRAs and Roth 401(k)s result in a different kind of tax expenditure. In these plans, employee contributions are taxed in the year that they are made, but withdrawal of money previously contributed and investment earnings are generally tax-free.

Why Are Tax Breaks Provided for Retirement Plans?

Congress provides tax breaks for retirement plans as a way of encouraging employers and workers to save for retirement. Because retirement seems remote to many workers, people will often give priority to more immediate needs. Retirement tax expenditures provide incentives for employers to create retirement plans for their employees, and for employees to save for themselves through workplace plans and through IRAs.

< Back